Image © Adobe Images

The Pound is at risk of entering a short-term downtrend against the Australian Dollar.

The Australian Dollar continues to strengthen against the Pound, lifted by ongoing improvements in global trade tensions as China and the U.S. creep towards trade negotiations.

Falling equity market volatility and rising stock markets confirm an improving global investor backdrop, and no G10 currency is better poised to benefit than the high-beta Aussie.

A strong U.S. jobs report was released last Friday, which boosted stocks and suggested tariffs were not having a significantly negative impact on the world's largest economy. That data followed news earlier in the day that China was ready to talk about entering trade negotiations with the U.S.

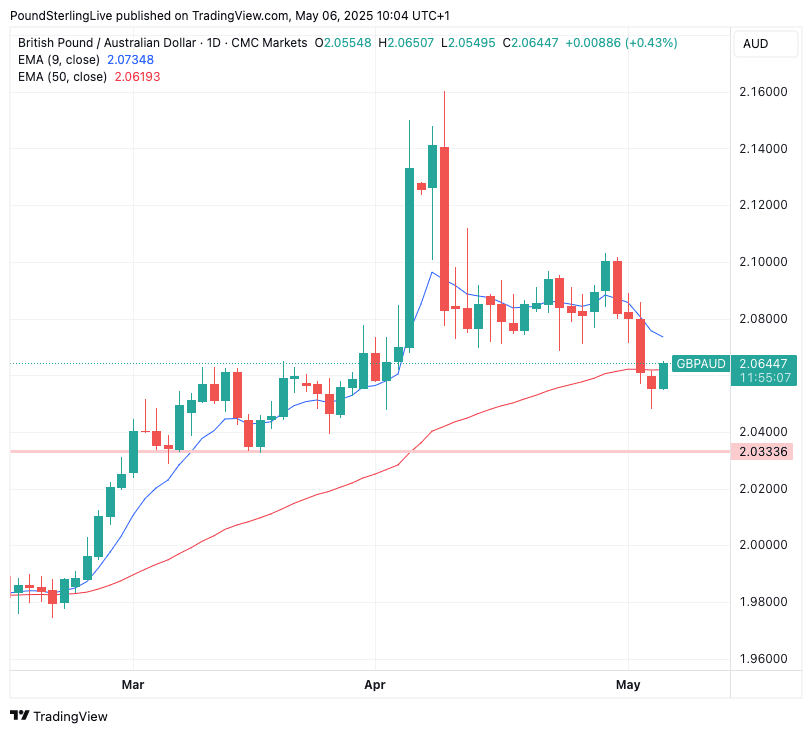

The net result was an AUD-positive impulse that pushed the Pound to Australian Dollar exchange rate (GBP/AUD) lower by 0.90% on Friday, taking it to below the 50-day exponential moving average on the daily chart.

The fall below the 50-day EMA signals a notable shift in momentum towards the downside in GBP/AUD and puts us on alert for further weakness. Monday's low at 2.0478 is an obvious first target ahead of a move to an approximated area of support at 2.0336.

Above: GBP/AUD at daily intervals.

GBP/AUD remains in a broader multi-year uptrend and the weakness we are seeing is likely to be a setback to that trend. We know that this exchange rate can be prone to big counter-trend moves that can last for a number of weeks before the bigger trend reasserts.

So while we are not calling the end of that big trend higher, a more meaningful setback is evolving.

Trade in the coming week will likely rest with the global pulse and how the U.S. and China move towards trade talks. Ultimately, they will, but both sides could frustrate the process if they adopt combative stances to reinforce their positions.

Markets will be watching the midweek Federal Reserve interest rate decision for guidance, as any hint at imminent interest rate cuts would boost stocks and provide the Australian Dollar with fresh impetus.

The Fed has reason to deliver some insurance interest rate cuts in the face of tariffs that Chair Jerome Powell recently acknowledged as being more severe than he had envisioned.

However, the official data does not yet reflect tariff uncertainty and fears of a sharp slowdown in imports, meaning the Fed has little concrete data on which to act.

This should ensure the meeting is a wait-and-see one, which should allow recent trends to extend.

And for GBP/AUD, that could mean further weakness.