Image © Adobe Images

Robust sentiment keeps Pound Sterling bid.

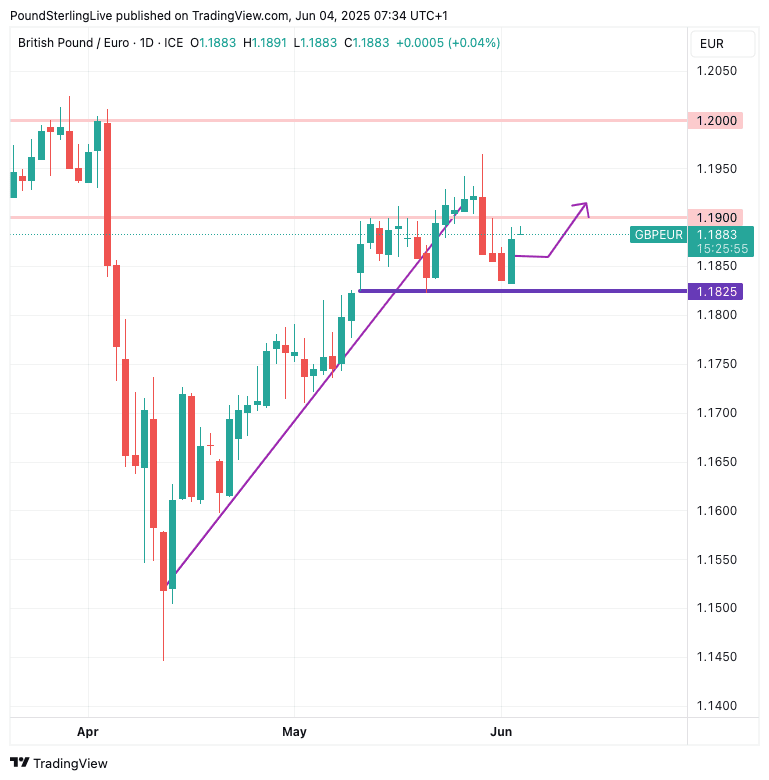

The Pound to Euro exchange rate (GBP/EUR) could be set to take a peek above the 1.19 level as we move through the midweek session, thanks to supportive investor sentiment.

GBP/EUR was last quoted at 1.1883 following Monday's 0.35% gain that lifted it off the floor at 1.1833.

The below chart shows the annotation made in Monday's Week Ahead Forecast for the exchange rate, confirming this FX pair to be broadly adhering to our expectations at the midpoint of the week:

Underpinning the steady tone in GBP/EUR are firming world stock markets, with Britain's FTSE 100 eyeing a fourth day of gains, and the U.S. S&P 500 testing levels last seen in February.

"Markets have steadily climbed with the S&P 500 up +1.86% since the lows after it was released, including another +0.58% gain yesterday as the headline JOLTS data was broadly positive," says Jim Reid, a macro strategist at Deutsche Bank.

The Pound-Euro exchange rate is highly sensitive to broader sentiment, tending to outperform when volatility is low, and further gains are possible if the mood music in equities stays supportive.

"The index is now up +19.82% since the closing low after Liberation Day, leaving it just shy of the 20% threshold that would technically mark the start of a bull market," says Reid.

Although the technical setup for the near-term remains constructive, and GBP/EUR can post levels above 1.19 again, we are wary of elevated risks that could yet scupper any meaningful advance.

We reported on Tuesday that equity market volatility could be poised to tick higher as Donald Trump beats the tariff war drums once more. This means weaker stocks and a softer Pound relative to the Euro.

"We think we're past peak optimism on the tariffs side, suggesting that we can see a recoupling of geomacro uncertainty and macro volatility once again," says Mark McCormick, Head of FX and EM Strategy at TD Securities.

Overnight, the U.S. raised steel and aluminium import tariffs to 50% from 25% to help domestic manufacturers and protect national security.

The move risks reheating global trade tensions and suggests the calmer waters of May are now in the rear-view mirror. Fears over the U.S. national debt will also be a theme to watch as the Administration seeks to get President Trump's One Big Beautiful Bill signed into law by July 04.

The bill is forecast to add $3.8 trillion to the $36 trillion national debt, according to the non-partisan Congressional Budget Office, while at the same time including legislation that will allow the Treasury to tax foreign investors on a whim.

Also, economic data from the U.S. bears watching and we await Friday's jobs report in particular for clues as to whether recent tariff uncertainty is impacting job creation. A headline 130K jobs are expected to have been created, and if the number undershoots expectations, stock markets could end the week in the red, scuppering the Pound's advance and pushing GBP/EUR back towards 1.1850.

ECB Poses Headwinds

Weighing on the Euro somewhat in the past 24 hours was news that domestically generated inflation - core inflation - had fallen to well within the European Central Bank's comfort zone, raising the prospect of further interest rate cuts.

"The euro faced selling pressure on Tuesday, weighed down by softer-than-expected inflation data and stronger US economic releases, reinforcing short-term headwinds for the currency," says George Vessey, Lead FX & Macro Strategist at Convera.

Core CPI inflation for the Eurozone fell to 2.3% year-on-year in May, significantly down on April's 2.7% and below consensus estimates for 2.5%.

The ECB will reflect on these figures in a Thursday policy decision that will see another rate cut, taking the main policy rate to 2.0%.

If guidance shows the Bank is warming to an 'easier' stance on policy in light of inflation, the Euro can fall further.