- Trump to go ahead with unilateral tariffs

- EUR is the preferred go-to when U.S. tariff concerns build

- GBP hampered by concerns over UK fiscal sustainability

Official White House Photo by Molly Riley.

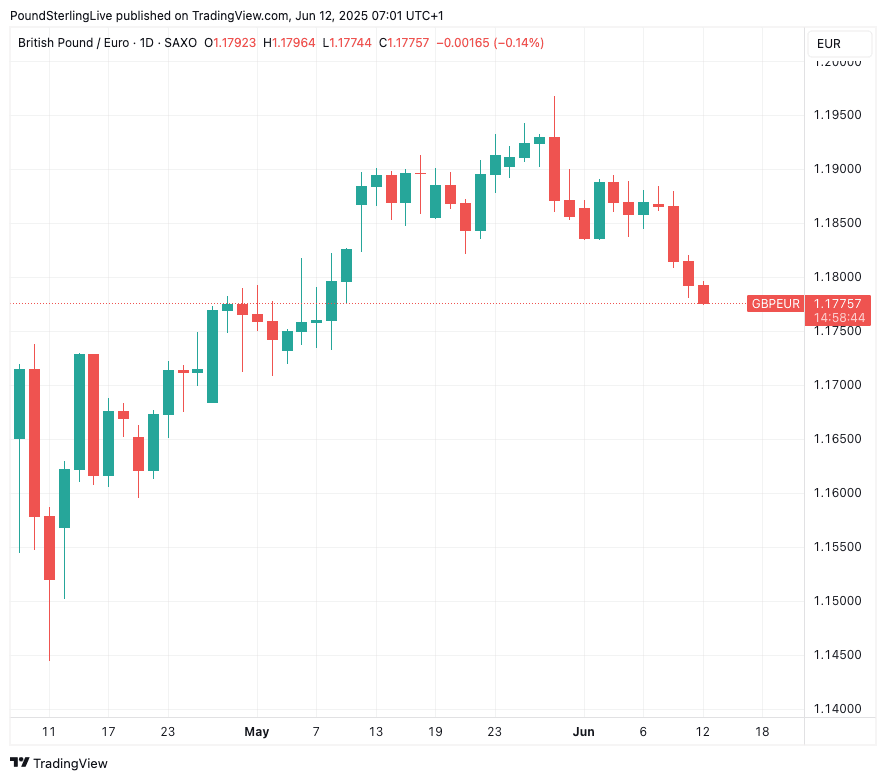

The Pound to Euro exchange rate dips below 1.18.

The Eurozone's single currency is firmly in charge, recording notable gains against all its main rivals in an atmosphere of renewed scepticism about the Dollar and British Pound.

"USD fell to near 98.4pts after President Trump reiterated his intention to send letters outlining unilateral tariff rates to trading partners within two weeks. The escalation in trade tensions weighed on risk sentiment and the USD," says Samara Hammoud, Currency Strategist at Commonwealth Bank.

The U.S. is still negotiating with a number of important trading partners and has only struck a deal with the UK. The U.S. team is too stretched and lacks the capacity to negotiate with the majority of smaller trading partners, who are yet to even start meaningful negotiations.

"We're going to be sending letters out in about a week and a half, two weeks, to countries, telling them what the deal is," Trump told reporters. "At a certain point, we’re just going to send letters out. And I think you understand that, saying this is the deal, you can take it or leave it."

The developments represent a ratcheting up of trade tensions, which investors tend to see as bad for the U.S. economy and the Dollar.

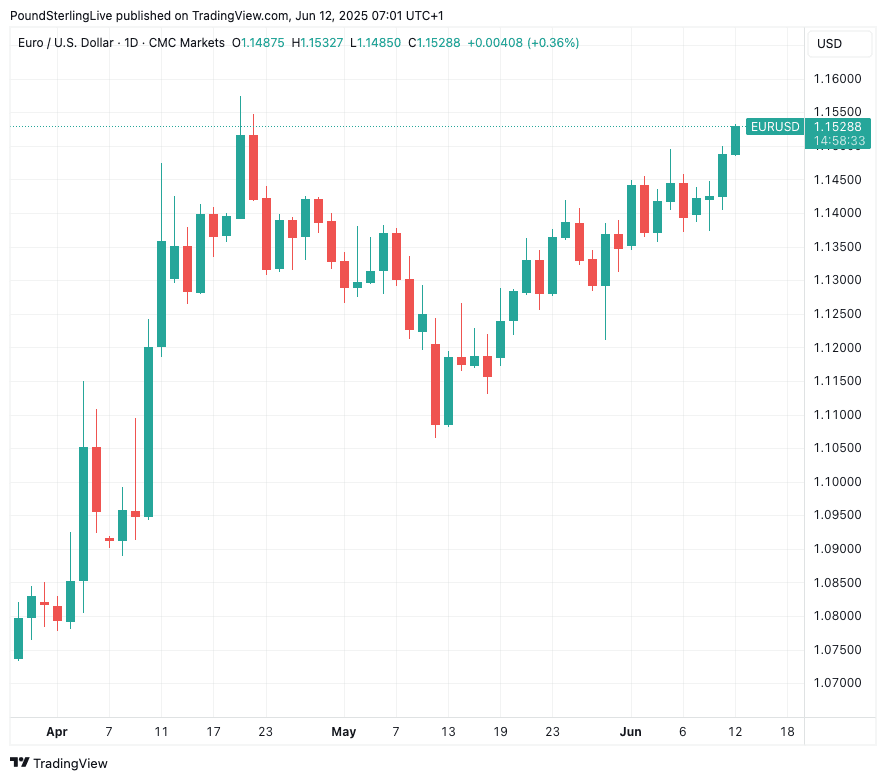

Above: EUR/USD outperforms.

"It feels like Groundhog Day, as the US dollar is once again losing ground across the board," says Achilleas Georgolopoulos, Senior Market Analyst at Trading Point. "Trump stated he will set unilateral tariff rates within two weeks, adding pressure on non-compliant countries."

The Euro is proving to be the main beneficiary of flows away from the Dollar, creating a powerful updraft for the Euro-to-Dollar exchange rate (up 0.33% today), which is now trading at 1.1523, close to the 2025 peak at 1.1572.

The Euro-Dollar rally is outpacing the Pound-to-Dollar exchange rate's rally, which means the Euro is outpacing Pound Sterling.

This is why the Pound to Euro exchange rate trades lower at 1.1784.

Above: GBP/EUR weighed by EUR outperformance and concerns about the UK's economic trajectory.

To be sure, concerns about the UK economy are also mounting, which only burnishes the attractiveness of the Euro:

Thursday saw the release of a surprise -0.3% month-on-month GDP figure for April, which was a bigger contraction than analysts were expecting and raises serious concerns about the economy's trajectory.

This follows Tuesday's employment data that put the wind up investors as it offers concrete evidence that the Labour government's job market policies and taxes on employment are leaving a clear mark. Employment fell 109K in May alone, the biggest drop since the Covid crisis.

The UK government is meanwhile pursuing a massive spending spree, with Chancellor Rachel Reeves promising to hand out an extra £190BN in government spending over the course of this parliament.

This will be paid for by a tax burden that is to rise to all-time highs, and extra borrowing, with Reeves hoping an economic revival will lessen the pain and keep lenders on side.

The risk is that this growth doesn't transpire, debt costs surge and markets lose confidence in UK assets.

With the Euro not facing similar issues, it's easy to see why it is the go-to currency of the moment.