- See our new GBP/EUR week ahead target

- GBP/USD upside intact, eyeing next key level

- Tariff jitters weigh on EUR and USD alike

Official White House Photo by Daniel Torok

Analysts say the outlook for the British Pound remains bullish.

This as Pound Sterling extends gains against the Euro and Dollar with investors focusing on the UK's solid domestic fundamentals and simmering EU-U.S. trade war risks.

The Pound to Euro exchange rate rose through the Friday session after U.S. President Donald Trump threatened the EU with a 50% trade tariff; however, he has since agreed to delay the tariffs by a month to allow talks to continue.

"We had a very nice call and I agreed to move it,” Trump said following a call with EU Commission President Ursula von Der Leyen.

“There’s now a new impetus for the negotiations,” Paula Pinho, a spokeswoman for the Commission, "They agreed both to fast track the trade negotiations and to stay in close contact.”

The developments have shored up an under-fire Dollar, which remains the biggest loser when tariff tensions rise. However, analysts warn that the sudden 50% tariff announcement serves as a reminder that risks on trade linger and can arise at a moment's notice.

"The renewed standoff between Trump and the EU is a reminder that tariff threats and delays can re-emerge quickly. If there’s a lesson from April, it’s that the dollar bears the brunt of tariff drama," says Francesco Pesole, FX Strategist at ING Bank.

He adds that "the greenback still isn’t trading in line with the classic market drivers. In many respects, it’ behaving more like an emerging market currency, where investors are fixated on public finance sustainability, watching capital flows closely, and forced to factor in unpredictable policy moves."

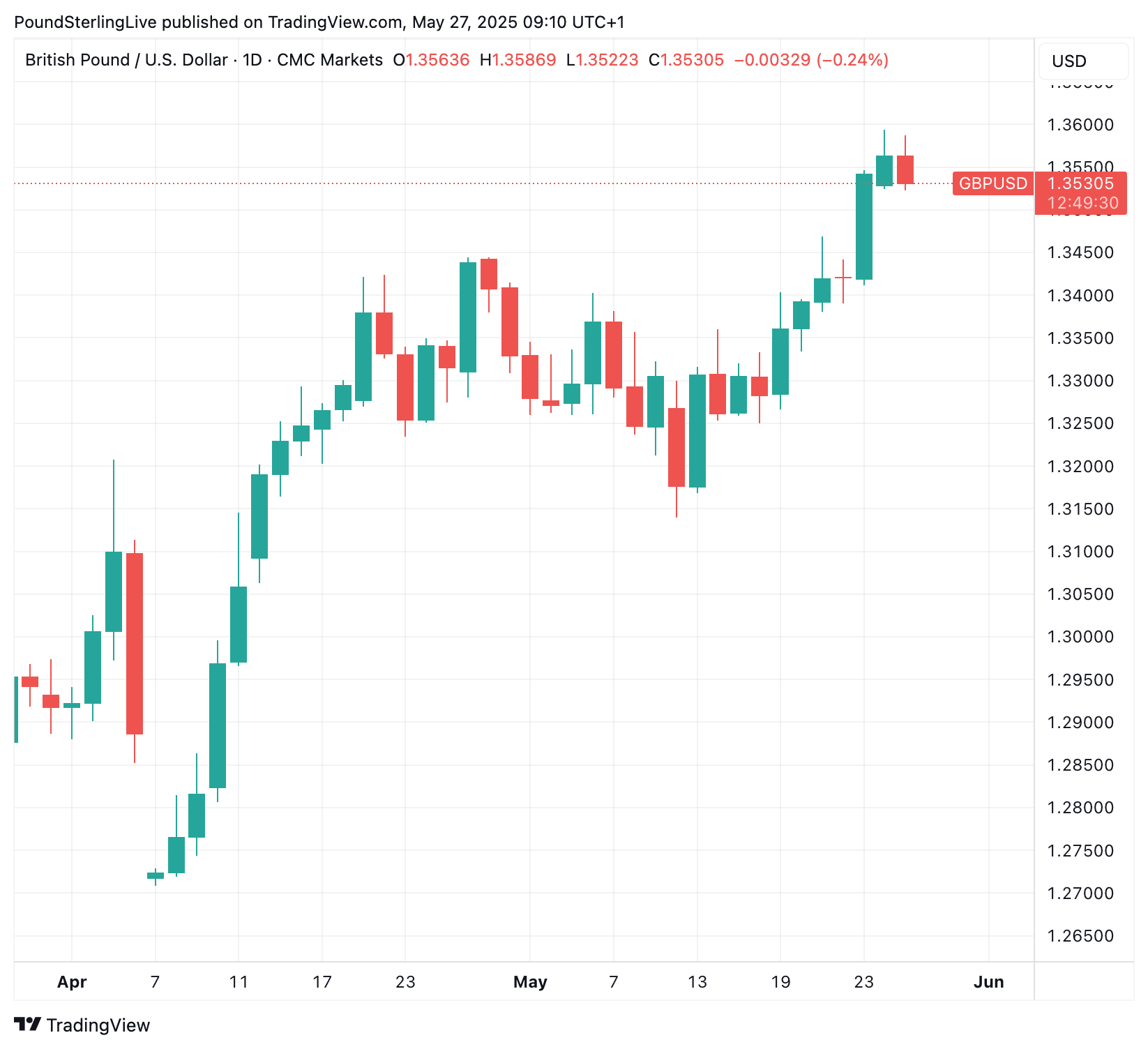

Above: GBP/USD at daily intervals.

This leaves the Pound to Dollar exchange rate (GBP/USD) trending upwards, with a new high at 1.3593 being reached on Monday.

"The GBP/USD pair has continued its upward trajectory for the third consecutive session, recently trading near the 1.3570 level - just shy of its 39-month high at 1.3593. This strong performance of the pound reflects continued market confidence in the British currency, supported by a mix of political and economic factors that have contributed to the dollar's recent decline," says Rania Gule, Senior Market Analyst at XS.com.

Gule says pullbacks should be shallow and that the bullish trend in GBP/USD remains intact, as long as the pair holds above the key support at 1.3550 and maintains the ascending channel it has respected in recent weeks.

"A breakout above 1.3593 could pave the way toward 1.3700, especially in the absence of clear signals for monetary tightening from the U.S. side," he explains.

Although the Euro advances against the Dollar during times of trade tensions, it is struggling against Pound Sterling.

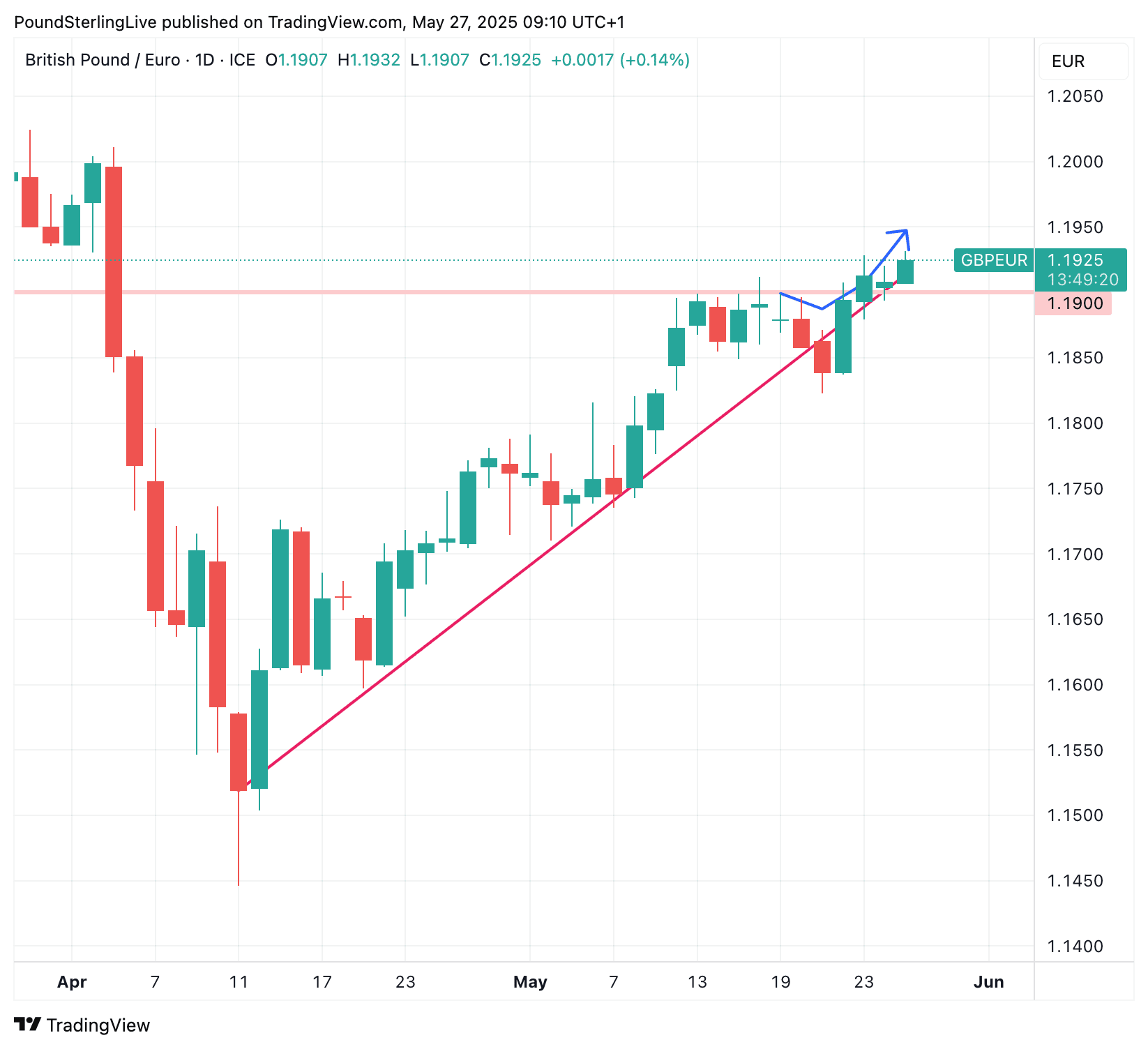

Above: GBP/EUR at daily intervals.

During the trade tensions of April, the Euro surged against the Pound. However, now that trade worries are focused on the EU, there is more at stake for the Euro as opposed to when trade fears were more generic.

Indeed, the U.S. and UK have already struck a trade accord that eliminates associated uncertainty for the UK.

Also, global stock markets are looking through the tariff noise and rising, meaning positive global sentiment supports GBP/EUR gains.

Technical studies are all pointing higher, and we think a steady rise to 1.1950 is possible this week.

"Support for the pound has also been reinforced by recent UK economic data. Retail sales rose by 1.2% in April — the fourth consecutive monthly increase — signaling resilient consumer spending despite economic headwinds. In my analysis, this reflects strong domestic demand and boosts investor confidence in the pound, as the consumer sector remains a key pillar of the UK economy," says Gule.