Above: The return of production at Jaguar Landrover will boost manufacturing output. Image © Adobe Images

UK GDP is tipped to beat expectations on Thursday.

Pound sterling faces its first domestic data release of the year on Thursday when the UK drops economic growth figures for November.

Economists expect the ONS to report GDP at a disappointing 0.0% in the month of November. Consensus expectations prime market traders who will base subsequent decisions to sell or buy the pound depending on how the data beats or undershoots the figure.

If the figure is stronger, the pound will rise; if weaker, it will fall. With this in mind, a respected economic forecaster reckons the consensus is far too pessimistic, and the economy should report an above-consensus reading.

"We expect November's GDP report, due on January 15, to show growth of 0.2% month-to-month, up from a fall of 0.1% in October," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

If this prediction is correct, the market would be expected to react by buying the pound, ensuring its solid start to the year carries into mid-month. (? Set your currency order now to capitalise on any post-GDP move).

Pantheon Macroeconomics, an independent provider of economic research, thinks manufacturing activity will recover, as Jaguar Landrover saw production recover following September's cyber attack. Hospitality and healthcare are also expected to have boosted the services sector.

Services activity likely "rose at a solid clip in November" driven by healthy growth in consumer-facing services, says Wood.

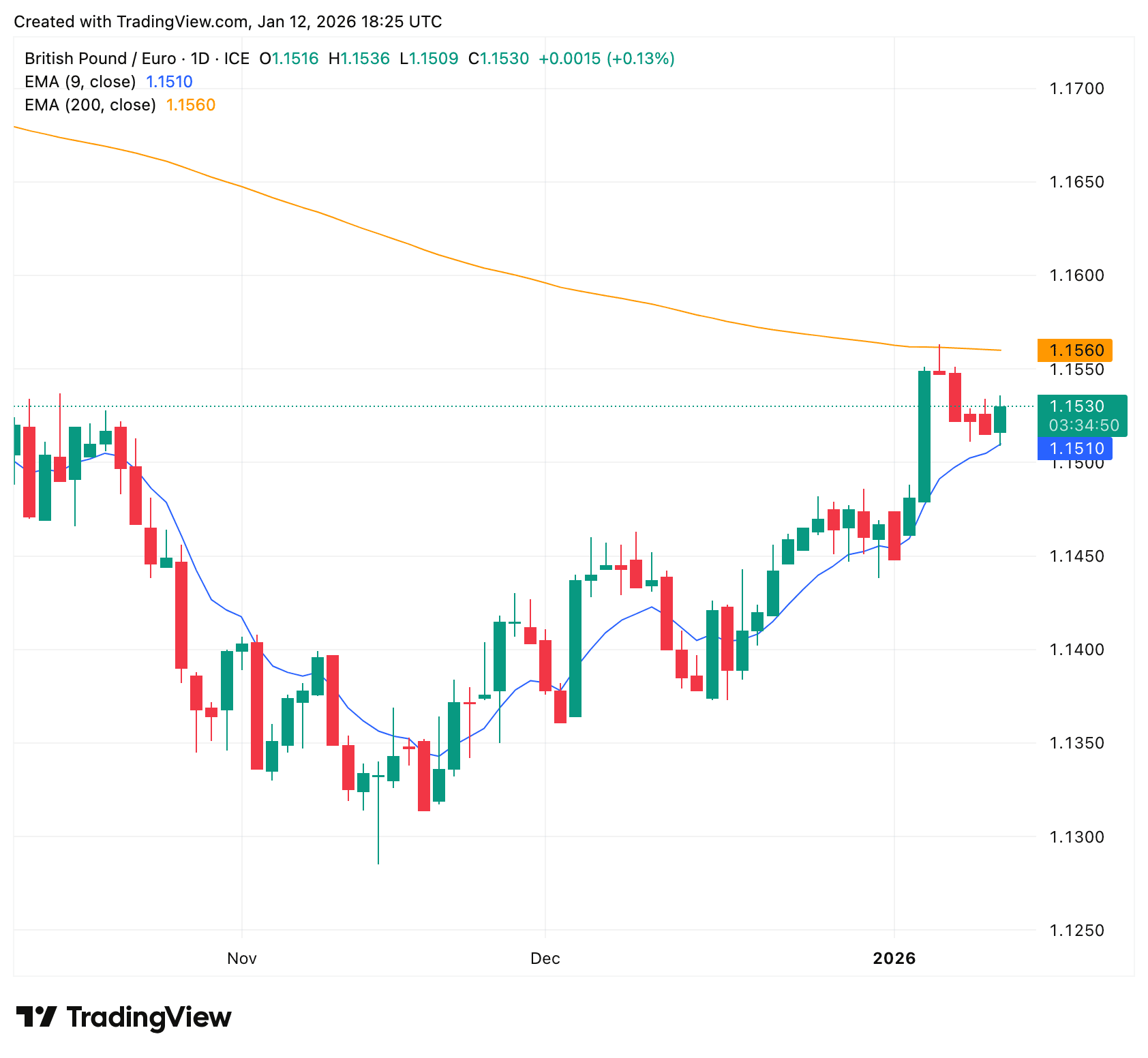

Above: GBP/EUR has recovered in the post-budget period.

However, survey data released ahead of the official GDP print offers reason for traders to maintain some caution.

The British Retail Consortium reports Tuesday that retail sales growth slowed to just 1.2% year on year in December, marking a notable slowdown on the previous December when growth was recorded at 3.2%.

Meanwhile, Barclays bank's debit and credit data shows spending on cards sank by 1.7% in December compared with a year earlier, making for the sharpest decline since February 2021, when the UK was still under Covid restrictions.

These survey data warn of two-way risks for the pound, confirming there's some uncertainty as to just how significantly the budget impacted consumer and business activity.

Pantheon Macroeconomics concedes that economic data covering H2 of 2025 is still likely to show the effects of budget uncertainty, and it won't be until the first quarter of 2026 that we get a sense of how the economy responded to that uncertainty lifting.

"Activity in Q1 2026 will have a greater bearing on the path for interest rates," explains Wood, judging that the Bank of England will want to see what a post-budget world looks like when making decisions on interest rates.

Pantheon Macroeconomics thinks the economy should rebound, forecasting GDP growth of 0.4% quarter-to-quarter in Q1 2026.

Such growth rates would exceed consensus expectations and generate the kind of data surprises that would prove supportive of the pound as a strong economic rebound lessens the need for the Bank of England to lower interest rates.

Pantheon forecasts the pound to euro exchange rate to recover to 1.17 by mid-year and the pound to dollar exchange rate to rise to 1.37.