- Key resistance line continues to hold back the rally

- We think it should eventually break

- UK wage data due out Tuesday

- U.S. inflation and UK spending review due Wednesday

Image © Adobe Images

Pound Sterling maintains an upward bias against the Dollar.

The Pound to Dollar exchange rate (GBP/USD) can extend an uptrend in a week that will be characterised by UK jobs data and a major review into the government's spending ambitions.

GBP/USD has been climbing all year, and fresh highs are still likely in the coming weeks and months.

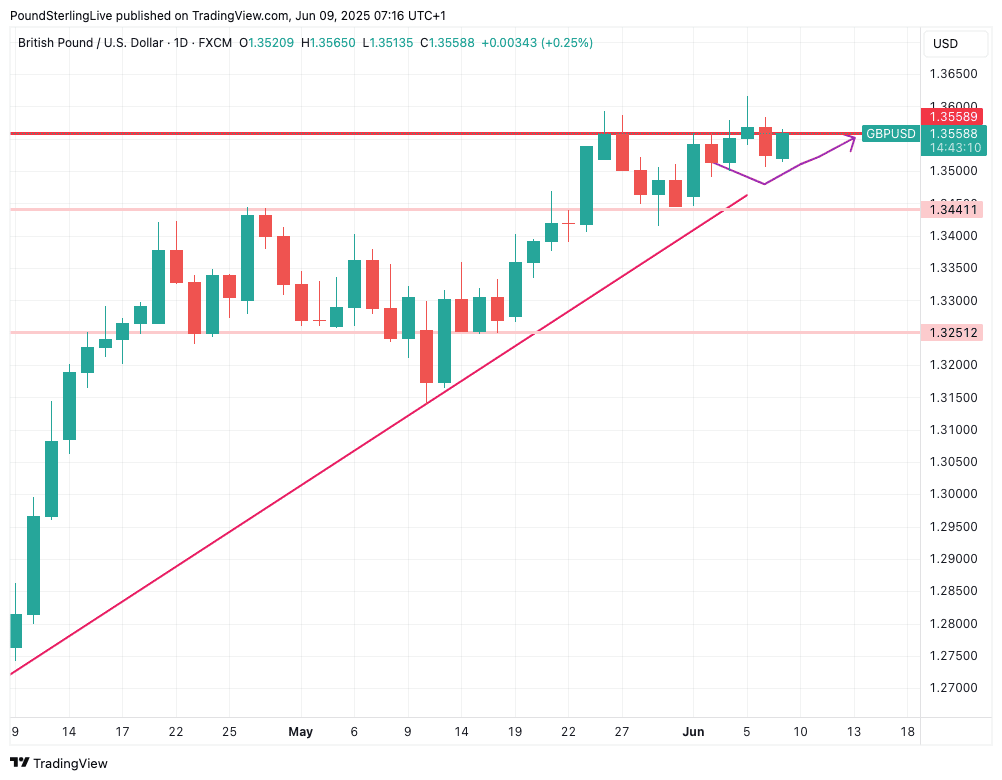

However, as the below shows, we have been of the view that a setback was becoming increasingly likely. The arrow in the chart was drawn in last Monday's Week Ahead Forecast edition, which proved to be largely correct.

Above: GBP/USD at daily intervals

The thesis was that a near-term rebound in the Dollar would pressure GBP/USD around existing levels. The Dollar was indeed boosted on Friday by an above-consensus U.S. jobs reading that confirmed the economy is yet to succumb to Donald Trump's tariffs and erratic policy making.

1.3559 is acting as an approximate layer of resistance, above which GBP/USD has failed to achieve a meaningful daily close in the past two years.

GBP/USD upside could be constrained further by a market that is now structurally positioned against the Dollar, potentially constraining the GBP/USD rally. This helps explain why there is near-term technical resistance thwarting the advance at current levels.

However, if the line can be crossed (look for a couple of consecutive daily closes above resistance), then we would judge it to be a sign that the bulls have retaken the initiative and the uptrend is rebuilding, bringing the highs just above 1.36 back into contention.

"We still think foreign investors will continue to see a stronger case for diversification ahead, especially when there are signs of a less-welcoming environment for foreign investors in U.S. assets. As a result, while Dollar depreciation may be shifting to a new phase, we still think it is here to stay," says Kamakshya Trivedi, FX analyst at Goldman Sachs.

Domestic data is back in focus this week, and Pound Sterling could be bolstered by Tuesday's labour market report that should show wages continue to rise at a clip, meaning inflation will stay elevated over the coming months.

The consensus looks for the two ONS measures of wages to read at 5.5% in April, implying little change from March. Anything above this would be considered inflationary (high wages = higher prices charged by businesses and higher domestic demand, both of which put pressure on prices).

On balance, this should bolster UK bond yields and the Pound.

Rachel Reeves will deliver the spending review on Wednesday. Picture by Kirsty O'Connor / Treasury.

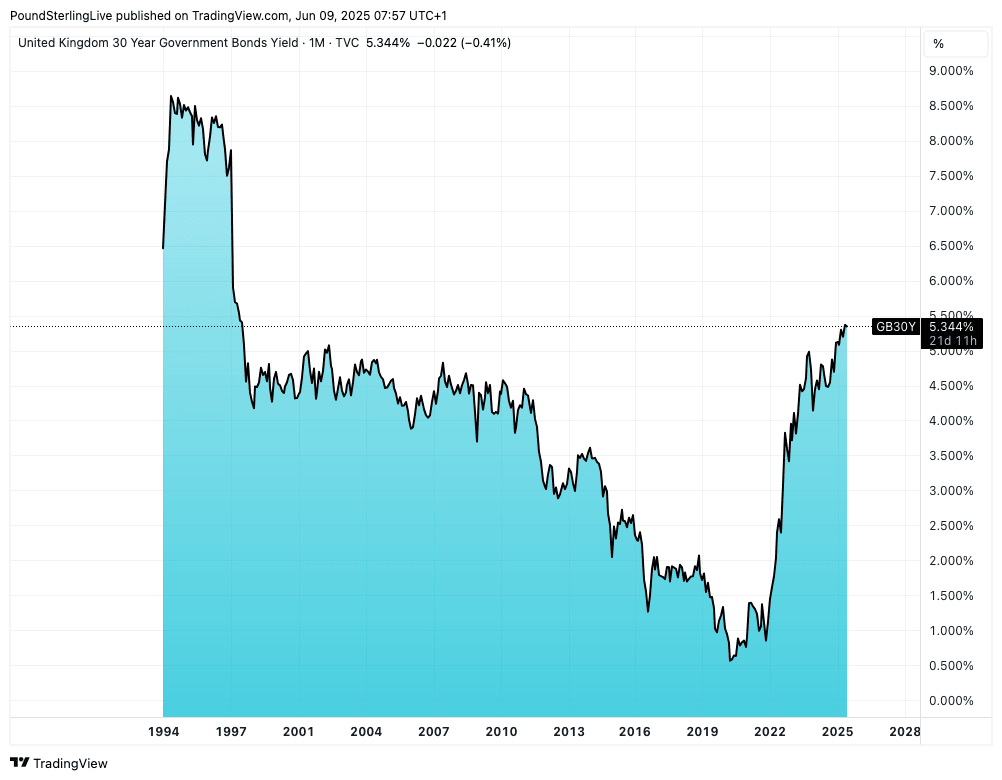

The critical Pound & bond yield relationship comes into sharper focus on Wednesday when UK Chancellor Rachel Reeves presents the government's spending settlements for the coming three years in the Spending Review.

This is not a budget, and taxes will therefore not be changed. However, it will be a test of credibility for the government, in which markets must remain convinced the UK's debt dynamics remain sustainable.

If doubts grow, UK bond yields risk rallying as investors demand greater compensation for buying and holding long-term UK debt. (A bond is what the government issues when it borrows. The yield is the 'interest rate' the bond pays investors. Higher yields imply investors want a bigger payoff for holding that debt, usually to account for inflation and any fears about the future sustainability of domestic finances).

Above: Long-term UK borrowing costs are now at their highest level since 1998. Shown: the UK 30-year bond yield.

Typically, the Pound tracks UK yields higher, as foreign investors snap up the higher returns that the UK offers. But, in times of elevated uncertainty (think Liz Truss), yields and the Pound go separate ways, potentially signalling a broader confidence crisis in the UK.

We think the odds of such a negative outcome happening this week are low, which means the Pound should easily navigate Wednesday. However, the warning to readers is that any mishaps by Reeves will be severely punished by the market, which would leave the Pound-Dollar exchange rate at risk of a deep pullback.

After all, the UK's debt dynamics are amongst the least favourable of all the major developed economies, and the government has thus far shown little ability to constrain spending. This is at a time when the U.S. continues to expand its debt pile, leaving global investors with significant debt supply to hoover up.

Image courtesy of Lloyds Bank.

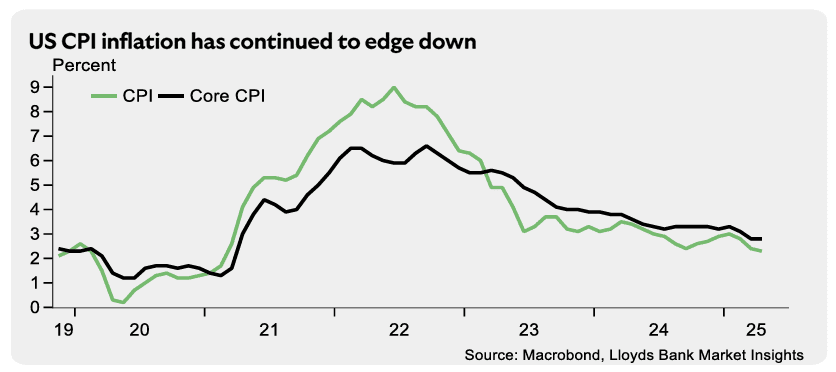

The major U.S. calendar event is Wednesday's inflation print, where a reading of 2.5% y/y is expected. Anything above here would lower the odds of a Federal Reserve rate cut in the coming months, and boost the Dollar.

That being said, U.S. interest rate expectations have been relatively irrelevant to the Dollar of late, meaning the broader diversification away from the U.S. by foreign investors in response to Trump's policies should remain the key driver of USD.

On this count, the outlook remains to the downside (GBP/USD higher).