Image courtesy of Daiwa Capital Markets.

The hit from tariffs is yet to come, putting the Dollar in a lose-lose situation.

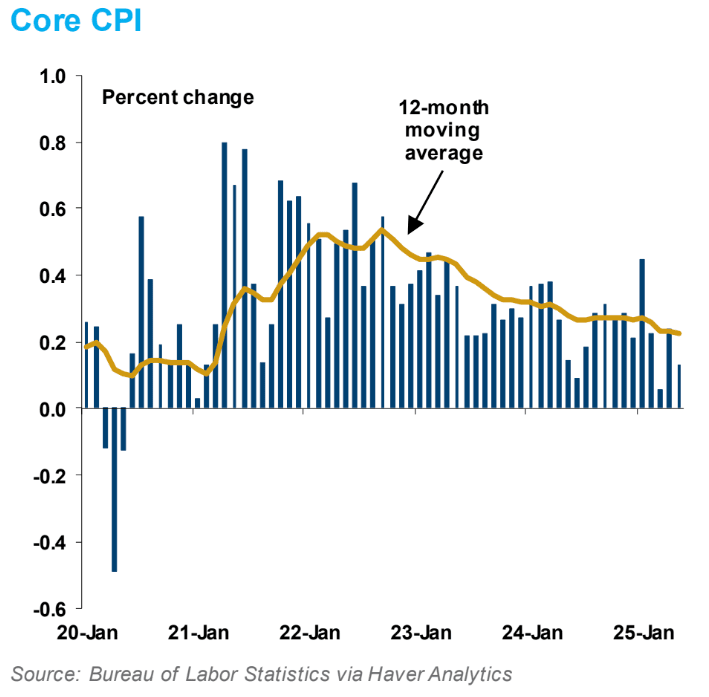

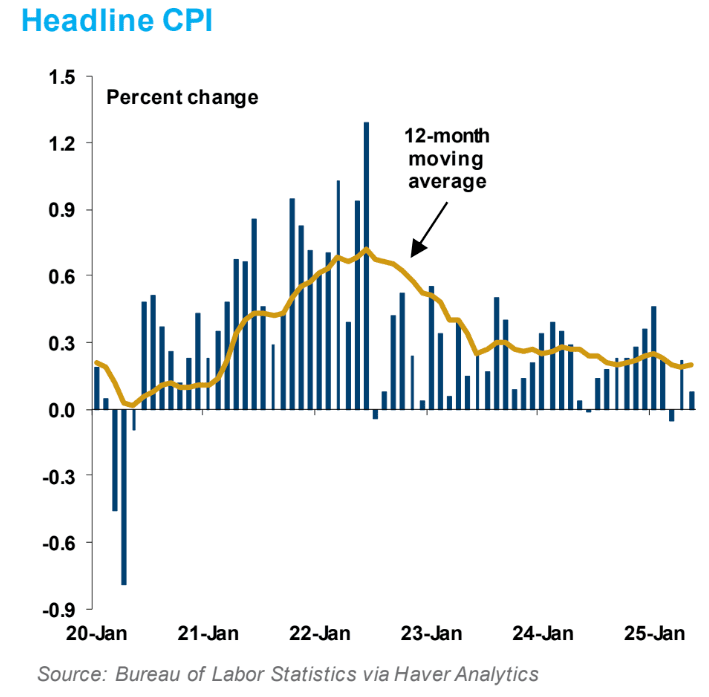

U.S. inflation data is trending lower, but economists warn the hit from inflation is on its way.

The Dollar fell after it was reported that headline CPI rose just 0.1% month-on-month in May, which was below April's 0.2% rise, a number the consensus expected to be repeated.

The annual rate of inflation rose from 2.3% to 2.4% year-on-year, but this was softer than the 2.5% the market was geared towards.

Rounding off the spate of below-expectation prints was the core inflation measure - which is closely aligned to the type of inflation the Federal Reserve targets - which rose 0.1% on the month, below consensus at 0.3% and decelerating from April's 0.2%.

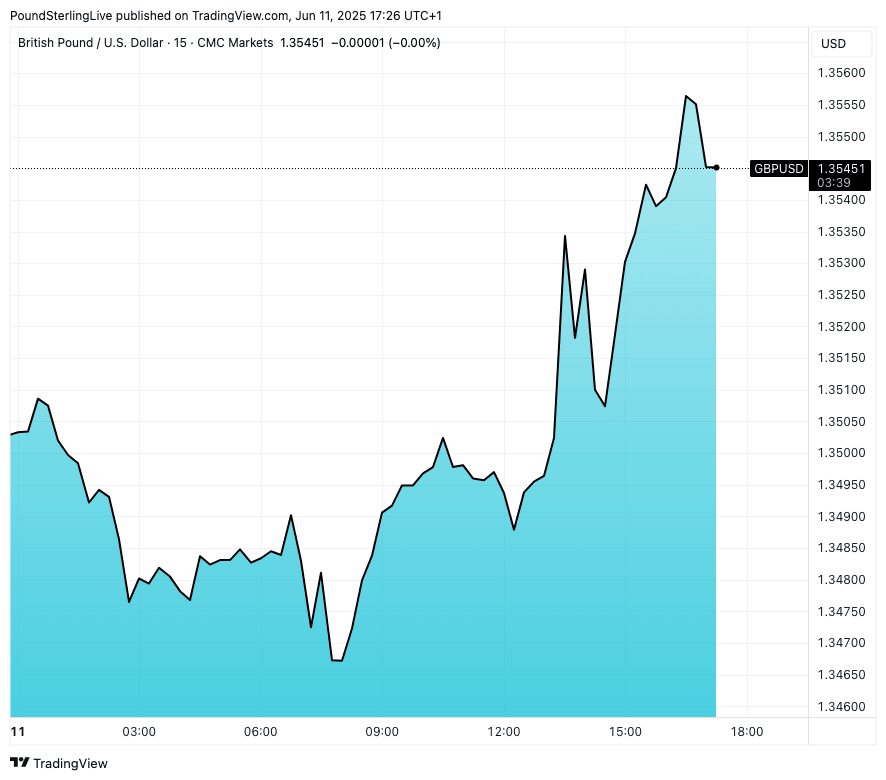

The Pound to Dollar exchange rate (GBP/USD) rallied after the release, reaching 1.3580 on Thursday, having been at 1.35 when the numbers were released.

The foreign exchange market's reaction suggests investors think these data will be enough to entice the Federal Reserve (Fed) into cutting interest rates on more than one occasion in the second half of the year.

Above: The GBP/USD reflects a strong market reaction to the June CPI edition.

Soft inflation numbers are therefore weighing on the Dollar, but economists warn inflation will move higher again as tariffs start to make an impact.

The problem for dollar backers is that it might just accelerate the selloff.

"We still anticipate that tariff-related price pressure will emerge in core goods prices in the next few months (likely peaking in Q3), but we maintain the view that ongoing trade negotiations, along with anchored longer-term inflation expectations, point to a one-off (and relatively short-lived) shift," says Lawrence Werther, an economist at Daiwa Capital Markets.

Image courtesy of Daiwa Capital Markets.

"Our wait for tariffs to raise retail prices will eventually be rewarded, but life happens along the way and what happened in the May CPI data is the impact of a slowing economy," says Steven Blitz, economist at TS Lombard.

The problem for the Dollar is that it might find that tariff-inspired inflation is of little help: it is the type of inflation that the Fed can't deal with (it's in Trump's hands) and is therefore largely irrelevant from a policy perspective.

However, it is still damaging for the economy in that it will push up U.S. bond yields, exacerbating concerns about the U.S. debt outlook. It could also prompt a more meaningful slowdown in economic activity, which is undoubtedly bad for the Dollar.

So the inflation story is turning out to be something of a lose-lose for the Dollar, underpinning the big selloff that is underway.

For Pound-Dollar, fresh highs beckon in H2.