Image © Federal Reserve

"A significant dollar fall" is on the cards, says veteran FX analyst.

Concerns over the Federal Reserve's independence reinforce the negative USD outlook, says Kit Juckes, head of FX research at Société Générale.

"Even if we assume that President Powell can't/won’t fire the Fed Chair, the makeup of the FOMC can change over time," says Juckes in a regular client briefing.

His comments follow another lurch lower in the Dollar following a renewed attack on Federal Reserve Governor Jerome Powell by President Donald Trump.

"There is virtually no inflation," said Trump on Truth Social. "There can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW."

Trump has increasingly said he wants lower interest rates to juice the U.S. economy, believing it won't stimulate inflation. It appears as though any economic slowdown stemming from his policy decisions, particularly regarding tariffs, will be pinned by the administration on the Fed.

However, economists and the Federal Reserve are wary that Trump's decisions will stimulate inflation, which would require interest rates to stand still, or even rise.

"Whatever other assumptions we make, it’s hard to avoid the conclusion that imposing draconian import tariffs on goods which have no easy domestic substitutes in the US, a country with little spare capacity anyway, will be inflationary (and ultimately, bad for growth)," says Juckes.

He explains that these ongoing developments will feed USD weakness:

"Add that into a mix that includes political influence over the Fed and unsustainably vast international investment imbalances (a structural failing of the post-Bretton Woods FX system, but that’s a different story), and we have a recipe for a significant dollar fall."

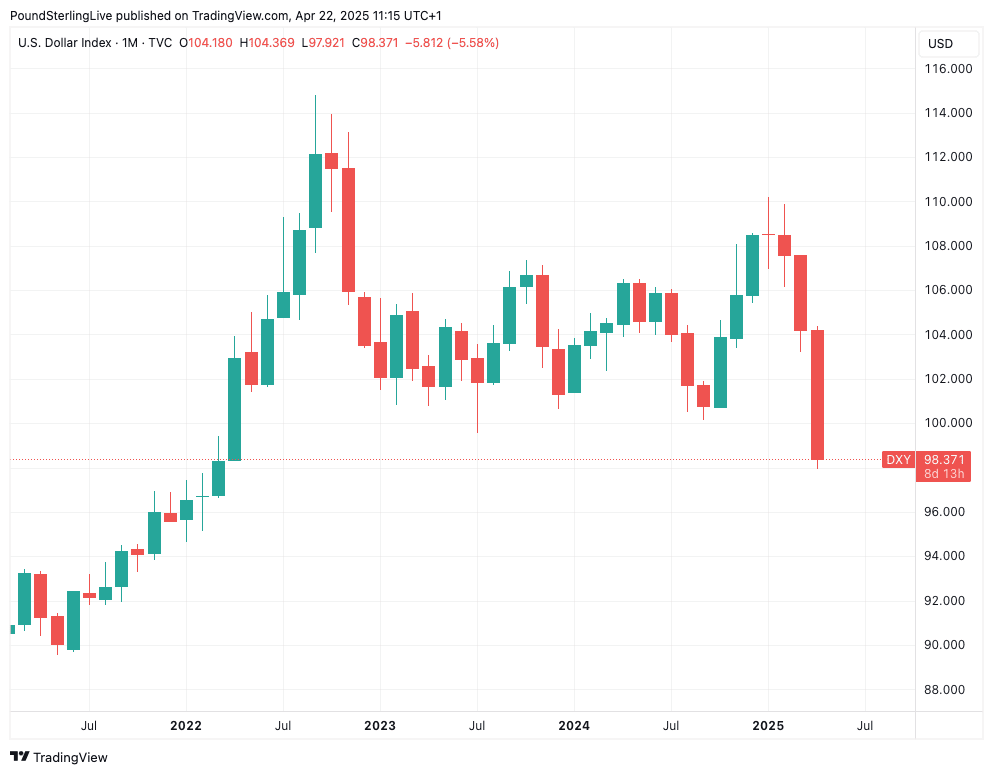

Above: The USD index at monthly intervals.

However, from a tactical standpoint, those watching the Dollar should be wary of bouts of strength, as positioning is now relatively heavy.

The latest CFTC data on how market participants are positioned show the market is reaching extreme levels of positioning, particularly against the EUR and JPY.

When markets are heavily invested in one direction (lower USD), the prospect of a sharp countermovement grows.

"One short-term support for the dollar comes from the latest CFTC data," says Juckes.

"Positioning, speed of movement, the lack of attraction of most of the alternative currencies and all that stuff, just means it won’t happen in a straight line," he adds. "Sell USD rallies or sell USD."