Image © Adobe Images

The Australian Dollar is back under pressure against Sterling.

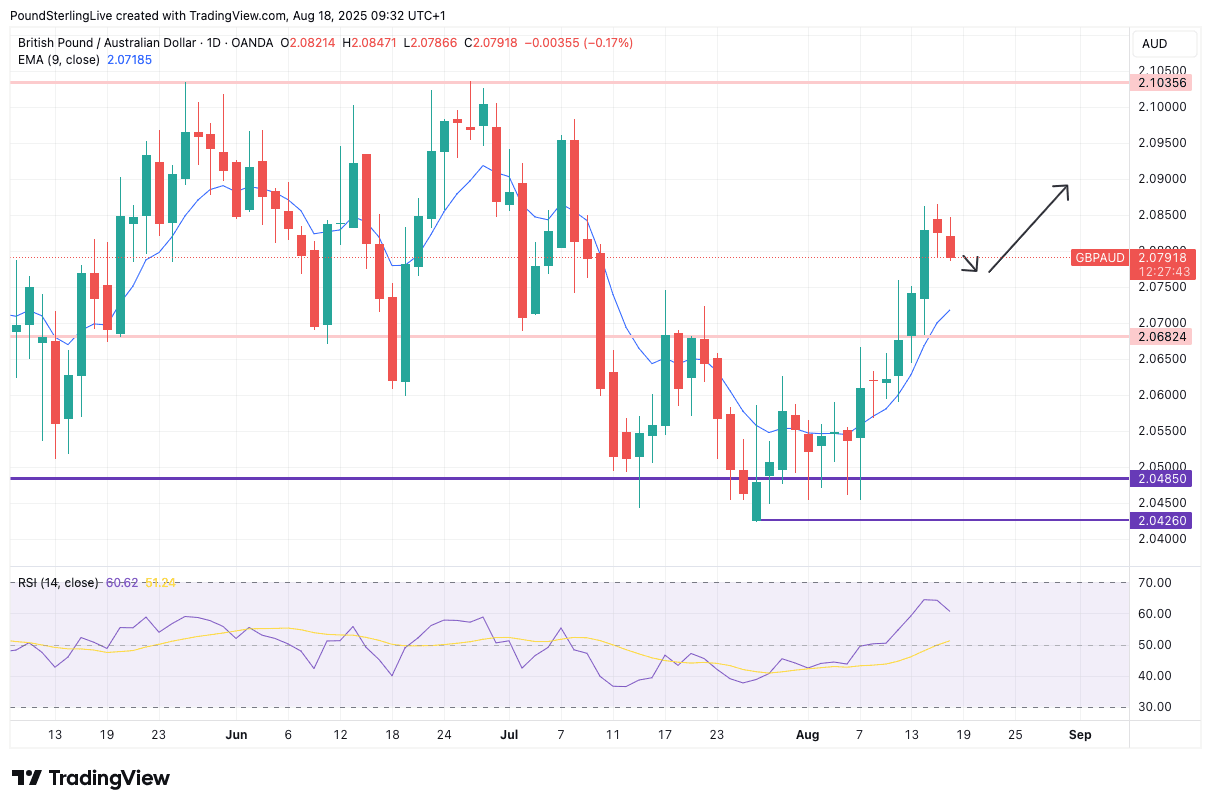

There's been a definite shift in tone on the Pound to Australian Dollar exchange rate (GBP/AUD): having been under pressure through July, it has recovered handsomely since August 07.

It's no coincidence that August 07 is when the Bank of England cut interest rates, but signalled the Monetary Policy Committee was finding it increasingly difficult to gain consensus in favour of further cuts.

At this point the odds of a November rate cut slumped from being a sure-bet to being now less than a 50-50 cointoss. In fact the market now anticipates just two more rate cuts over the remainder of the entire cutting cycle.

So there has been this fundamental shift in UK interest rate expectations that has benefited the Pound. Higher interest rates in the UK relative to Australia make the GBP a winner in the carry trade when contrasted to AUD.

Also, last week's below-consensus Chinese economic data prints seem to have weighed on the AUD and NZD more broadly, as China is a crucial driver of export demand for both antipodean countries.

It's little wonder then that GBP/AUD has shifted up into its 2025 range following a decent run of daily gains.

The daily chart does, however, signal that the rally was at risk of getting overextended, with the Relative Strength Index racing up into the late 60s; a reading of 70 would officially trigger overbought conditions.

GBP/AUD's gains also took it too far away from the nine-day exponential moving average (EMA), which also suggested overbought conditions and the need for some consolidative action.

It is that consolidative action we look for in the first half of the week, so we wouldn't be surprised to see a dip lower towards 2.07500.

Midweek brings UK inflation data, which could underpin that feeling that the Bank of England can't afford to cut interest rates too much further for fear of stimulating inflation. If the inflation data beats expectations (3.7% y/y for CPI) then the GBP can gain.

But, be wary, a massive overshoot could have the opposite effect as it would sound warning bells that UK inflation risks upsetting financial markets and triggering a growth slowdown.

Thursday's PMIs will be important for GBP too, as this will give an insight into how the economy did in August. The assumption is that it put in some decent growth, so there could be some more good news for Sterling here.

Given this we are inclined to think that following a brief pullback GBP/AUD will still be able to end the week higher than where it started.