Image © Adobe Stock

The Pound to Australian Dollar exchange rate has receded from post-referendum highs in recent trade and could be set to consolidate within a rough 2.0724 to 2.0994 range through the days ahead as markets process a cacophonic array of policy-related statements coming from the White House and its spokespeople.

GBP/AUD has traded in a narrow range since the eve of Passover, having receded from near 2.1648 and its highest level since before the 2016 Brexit referendum in the wake of US President Donald Trump’s “Liberation Day,” tariff announcement, which weighed heavily on the US Dollar in the intervening period.

The pair was little changed late on Tuesday when the US Dollar rallied after Trump walked back his earlier suggestions that Federal Reserve Chairman Jerome Powell could be fired over the current level of interest rates, and after the Treasury Secretary reportedly suggested a trade deal with China is at hand.

“The comments came “from behind closed doors”, so they are not yet official,” says Chris Weston, head of research at Pepperstone, in a Wednesday market commentary. “Headlines from Trump’s post-market interview do provide some validation to Bessent’s closed-door comments, with the President's views that China tariffs "won't be 145%" and that China will be “very happy” resonating across broad markets.”

Above: GBP/AUD shown at daily intervals with Fibonacci retracements indicating possible areas of support. Click for closer inspection.

The gripes over the Fed came amid an extended period of adverse reactions to the “Liberation Day” tariff announcement of April 7, which led to sometimes-simultaneous declines in stocks, bonds and the US Dollar.

GBP/AUD has long had a positive correlation with the broad US Dollar and that suggests it would struggle to rise much in the near-term if the market remains leery of the greenback over the coming days, while also implying that any further recovery of the US currency would likely lift the pair.

“AUD/GBP will lift modestly this week towards resistance at 0.4875 (38.2% fibbo) [2.0512 in GBP/AUD],” says Joseph Capurso, head of international and sustainable economics at Commonwealth Bank of Australia.

“Weak PMIs can support market pricing for further cuts from the Bank of England (BoE) and support AUD/GBP. GBP/USD will lift this week, alongside a stronger EUR/USD, in our view, he adds.

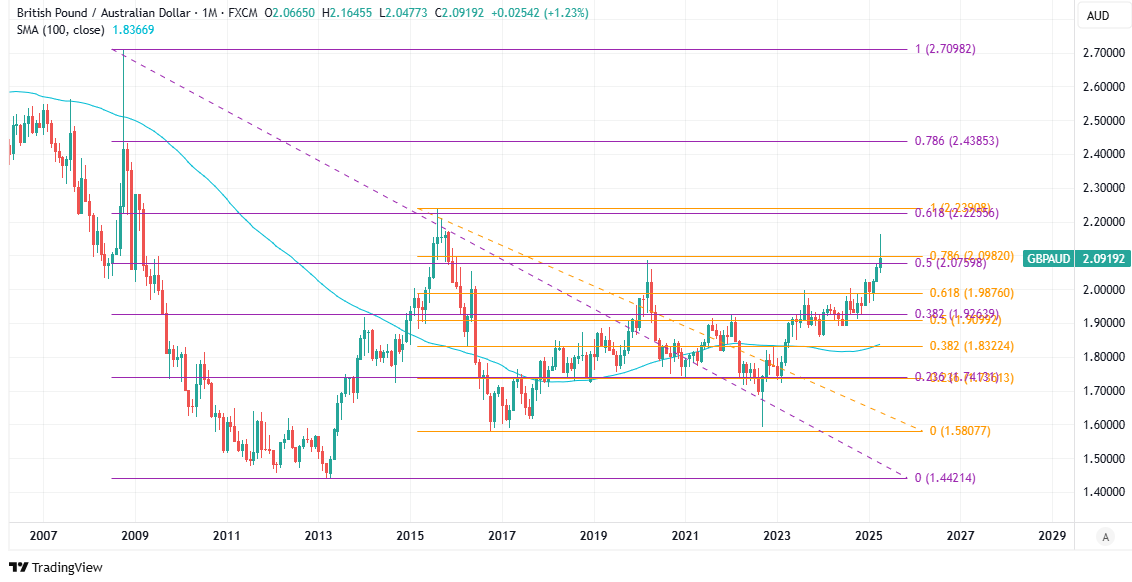

Above: GBP/AUD shown at monthly intervals with Fibonacci retracements indicating major long-term resistance levels. Click for closer inspection.