Image © Adobe Images

China's dismissal of trade talks points to ongoing Australian Dollar weakness.

The Australian Dollar was softer against the Pound and other major currencies after Chinese authorities told the U.S. to abandon its trade tariffs, suggesting the trade war was set to rumble on.

"The U.S. should respond to rational voices in the international community and within its own borders and thoroughly remove all unilateral tariffs imposed on China, if it really wants to solve the problem," He Yadong, the Ministry of Commerce's spokesman, said at a regular briefing on Thursday in Beijing.

The Pound-to-Australian Dollar exchange rate recovered to 2.0849 on Thursday following news of the Chinese stance, which also prompted a renewed weakness in global equity markets.

Price action confirms the Australian Dollar as being highly sensitive to Chinese economic developments and global equity markets.

Yadong also dismissed the prospect of any imminent progress towards fully-fledged trade negotiations with the U.S.:

"Any reports on development in talks are groundless". He called on the U.S. to "show sincerity" if it wants to make a deal.

Stocks and the Australian Dollar rose through the midweek trading session following signs that U.S. President Donald Trump was mellowing his stance towards China.

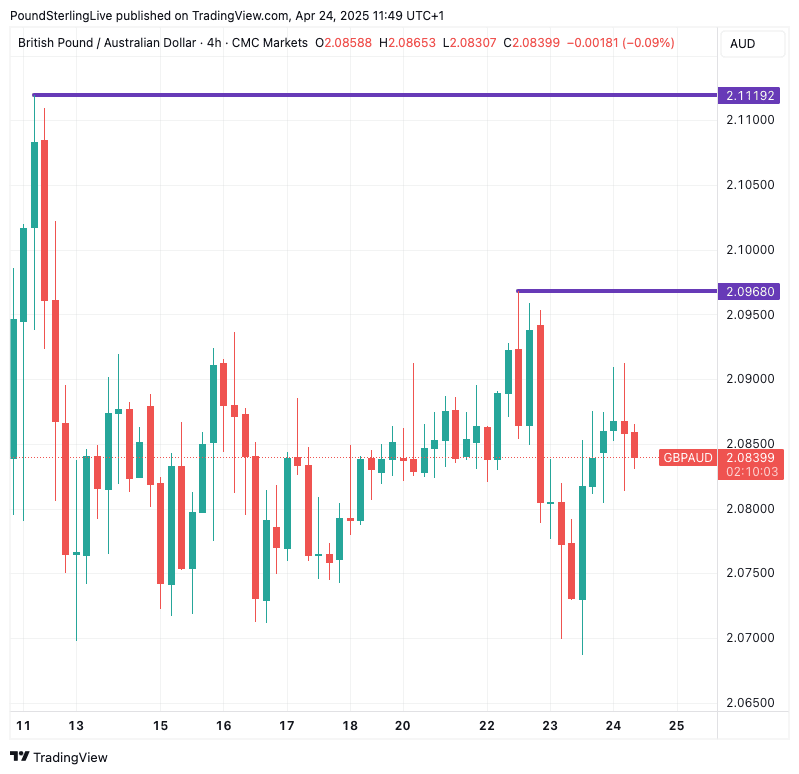

Above: GBPAUD at daily intervals with achievable upside levels.

Trump said on Tuesday he planned to be "very nice" to China in trade talks and that tariffs could drop in both countries if they could reach a deal, adding: "It will come down substantially, but it won’t be zero."

Axios reported on Wednesday that Trump appears to have been spooked into shifting stance by the CEOs of three of the nation's biggest retailers — Walmart, Target and Home Depot.

In a meeting, they privately warned Trump that his tariff and trade policy could disrupt supply chains, raise prices and empty shelves.

"The big-box CEOs flat out told him [Trump] the prices aren't going up, they're steady right now, but they will go up," an administration official familiar with the meeting told Axios. "And this wasn't about food. But he was told that shelves will be empty."

"The unvarnished scare seemed to work," officials told the news organisation. "For the first time, Trump seems more persuadable that his initial plan was too dangerous and disruptive. This slight shift helps explain why he vowed not to fire Fed chair Jay Powell, and publicly said tariffs on China will come down."

Above: U.S. policy making appears to be conducted on the fly, in front of the media. Image: President Donald Trump speaks to members of the media outside the White House, Wednesday, April 23, 2025. (Official White House Photo by Joyce N. Boghosian).

The Australian Dollar has fallen 3.0% against the Pound in 2025 as investors see Australian financial assets as being more exposed to the negatives of a U.S.-China trade war.

For the currency to reverse losses, it would likely require a clear end to the trade war, but with China unwilling to roll over, such an outcome still looks some way off.

For GBP/AUD, the mood music suggests a move to 2.0968, the Tuesday high, is imminently achievable, ahead of a test of 2.1192.

However, should Trump maintain a newfound caution based on what the bosses of the U.S. supermarkets warned, the outlines of a more protracted decline will start to appear.