Image © Adobe Images

CAD poised to rally as Scotiabank bets on fading U.S. dollar dominance.

Scotiabank has upgraded its outlook for the Canadian dollar, citing broad-based U.S. dollar depreciation, a shift in global capital flows, and policy momentum in Canada that could support growth and bolster the currency.

In its latest forecast tables published on June 11, the Canadian-based lender said it now expects the USD/CAD exchange rate to fall to 1.34 by the end of 2025, before strengthening further to 1.28 in 2026, reflecting a meaningful appreciation in the loonie.

"We now foresee a significant appreciation of the Canadian dollar going forward," says Shaun Osborne, Chief FX Strategist at Scotiabank. "The U.S. dollar has been depreciating even as tariffs hit… and relative borrowing costs rise."

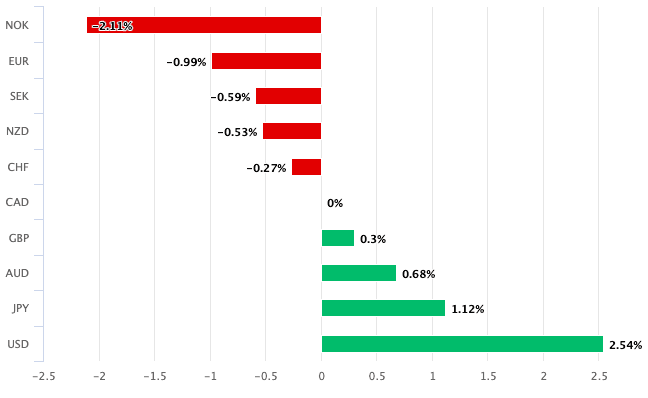

The Canadian Dollar is trending stronger against the Dollar but has put in an improved performance against other peer currencies over the course of the past month, suggesting some idiosyncratic legs of support.

"The CAD’s strength is fundamentally driven, reflecting an important shift in the outlook for relative central bank policy, initially on the back of last week’s BoC and policymakers’ reluctant shift toward neutral and subsequently followed by the latest softness in US CPI that has delivered a more dovish repricing of Fed expectations," says Osborne.

He adds that the latest gains in oil are providing the CAD with an added boost.

Scotiabank's forecast revisions come as investors reassess the attractiveness of U.S. assets in light of fiscal uncertainty, rising long-term yields, and declining confidence in U.S. policy direction.

Above: CAD performance over the course of the past month against G10 peers.

Scotiabank noted that the U.S. dollar’s decline, counterintuitive in the face of tariffs and elevated interest rates, reflects a broader questioning of U.S. economic leadership.

"Concerns about U.S. fiscal plan(s) have led to a rise in U.S. borrowing costs… [and] a general malaise about the direction of U.S. policy has contributed to exceptional moves in currency markets," the bank wrote.

While Canada’s economy is forecast to slow, with GDP growth estimated at 1.4% in 2025 and 1.1% in 2026, Scotiabank flagged upside risks tied to federal and provincial fiscal support.

A national income tax cut, housing incentives, and increased defence spending could underpin domestic demand.

"The government has already eliminated the GST on new homes under $1 million for first-time homebuyers," the report noted. "It is clear that much is happening in the policy space… that have the potential to raise growth (and debt) going forward."

Still, the Bank of Canada is expected to keep rates unchanged through 2025 before easing next year. Scotiabank forecasts 50 basis points of rate cuts in 2026, assuming inflation moderates and growth remains below potential.

"It is more likely that the policy rate will be cut in 2026… but that outcome will depend critically on the evolution of the trade war, how households and businesses have responded, and the policy supports deployed," economists said.

CAD Forecasts

Scotiabank also sees the Canadian dollar strengthening relative to other major currencies. The GBP/CAD pair is expected to fall from 1.80 in early 2025 to 1.64 by end-2026, while EUR/CAD is forecast to decline from 1.56 to 1.44 over the same period.

Though growth remains uneven across provinces, with oil-producing regions outperforming Ontario and Quebec, Scotiabank sees national inflation easing gradually, creating room for monetary policy adjustment and supporting currency stability.

"With the USDCAD heading for 1.34 in 2025 and 1.28 in 2026, the CAD is on track to outperform amid persistent global rebalancing and a weaker greenback," the report said.