- Global risk sentiment has lifted NZD

- And RBNZ’s tone has turned cautious on inflation

- Yet, domestic demand remains fragile

Image © Adobe Images

There are some positives building for the NZD in H2 according to new research.

Investment bank analysts say the New Zealand Dollar is navigating a complex landscape shaped by shifting Reserve Bank of New Zealand (RBNZ) policy signals, fragile domestic demand, and a sharp rebound in global investor sentiment.

Updating clients on potential H2 performance, analysts say the ongoing global equity markets rally and central banks recalibrating policy paths mean the NZD may find itself at a pivotal turning point in the weeks ahead.

Morgan Stanley says a tonal shift in the RBNZ's May statement could be key, noting the central bank’s rising concern that evolving trade tariffs could fuel inflationary pressures.

The RBNZ also described fiscal policy as "broadly neutral," signalling confidence that Finance Minister Nicola Willis’ restraint will not materially weigh on rate expectations.

With the RBA clearly on a more dovish trajectory than the RBNZ, Morgan Stanley argues the relative outlook now favours NZD over AUD.

"A break below 1.06 in AUD/NZD opens potential to 1.02 if the New Zealand economy proves resilient," the bank said, positioning NZD for outperformance if inflation risks deter further cuts.

MUFG notes that the NZD, alongside fellow high-beta commodity currencies like AUD and NOK, has benefited from a resurgence in global risk appetite.

The MSCI ACWI index recently hit record highs following the delay of reciprocal U.S. tariffs and a U.S. court ruling that deemed several tariffs illegal — developments that have lifted sentiment and temporarily eased fears of a deepening trade war.

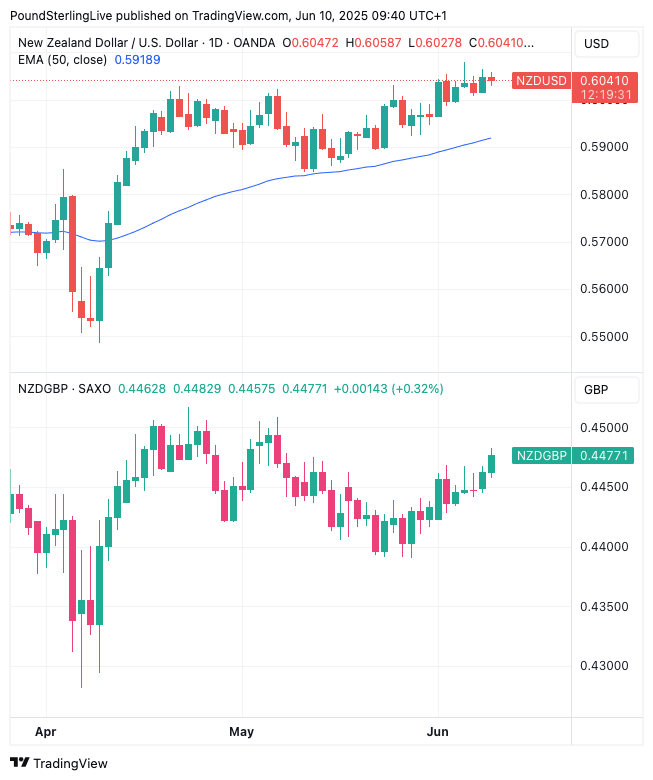

Above: NZD/USD (top) and NZD/GBP.

While NZD's sensitivity to global equities is well-established, questions remain about the durability of this rally, especially if trade tensions re-escalate or domestic weaknesses in New Zealand start to bite harder.

Despite the relatively hawkish stance expressed by the RBNZ in May, Barclays remains cautious on the NZD’s broader outlook.

The bank characterises the May RBNZ cut as "hawkish" due to its alignment with neutral rate estimates, but warns that domestic economic risks remain tilted to the downside.

With restrictive policy still working its way through the system, Barclays sees a meaningful risk that the RBNZ may yet be forced to cut the Official Cash Rate (OCR) into accommodative territory, a move that is not yet fully priced by markets.

This introduces downside risk to the NZD, especially if incoming data disappoints.